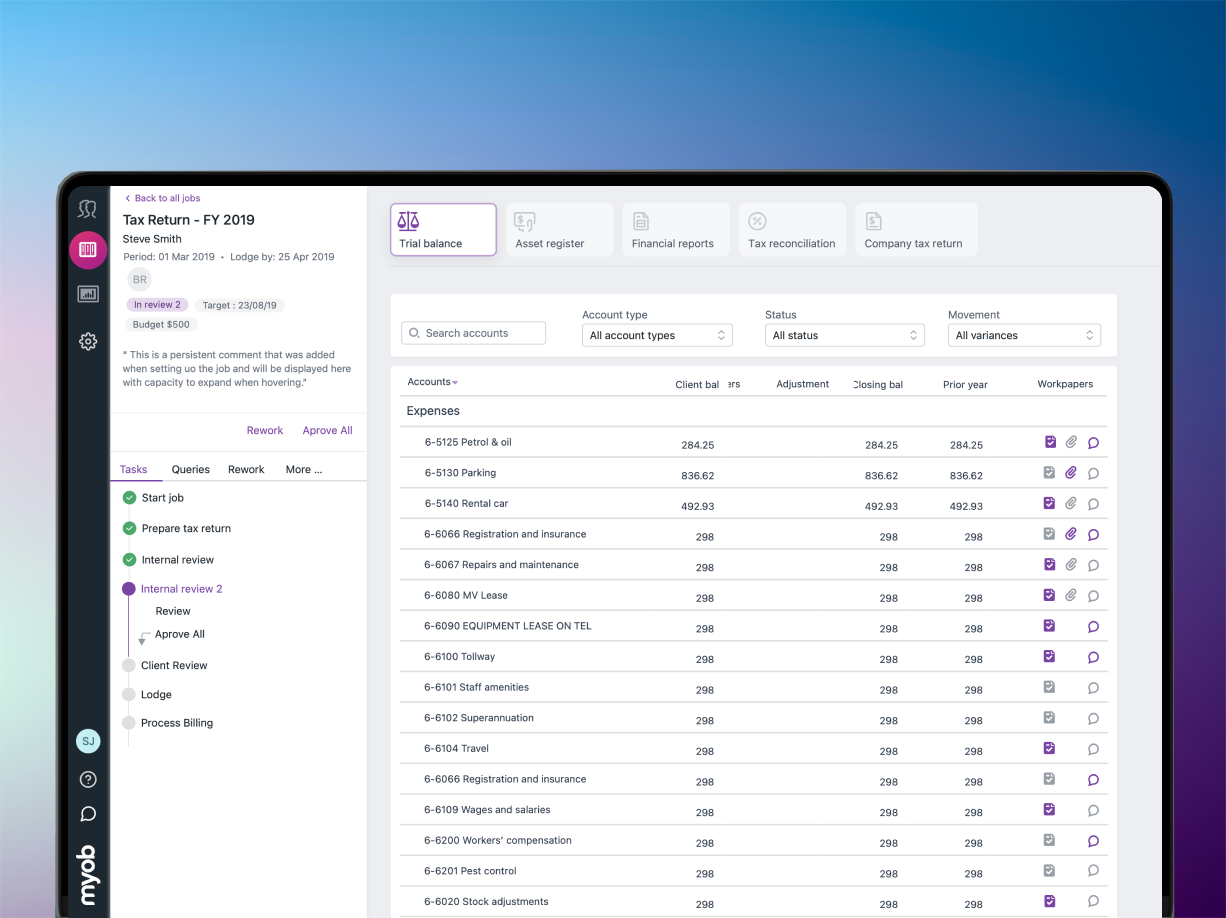

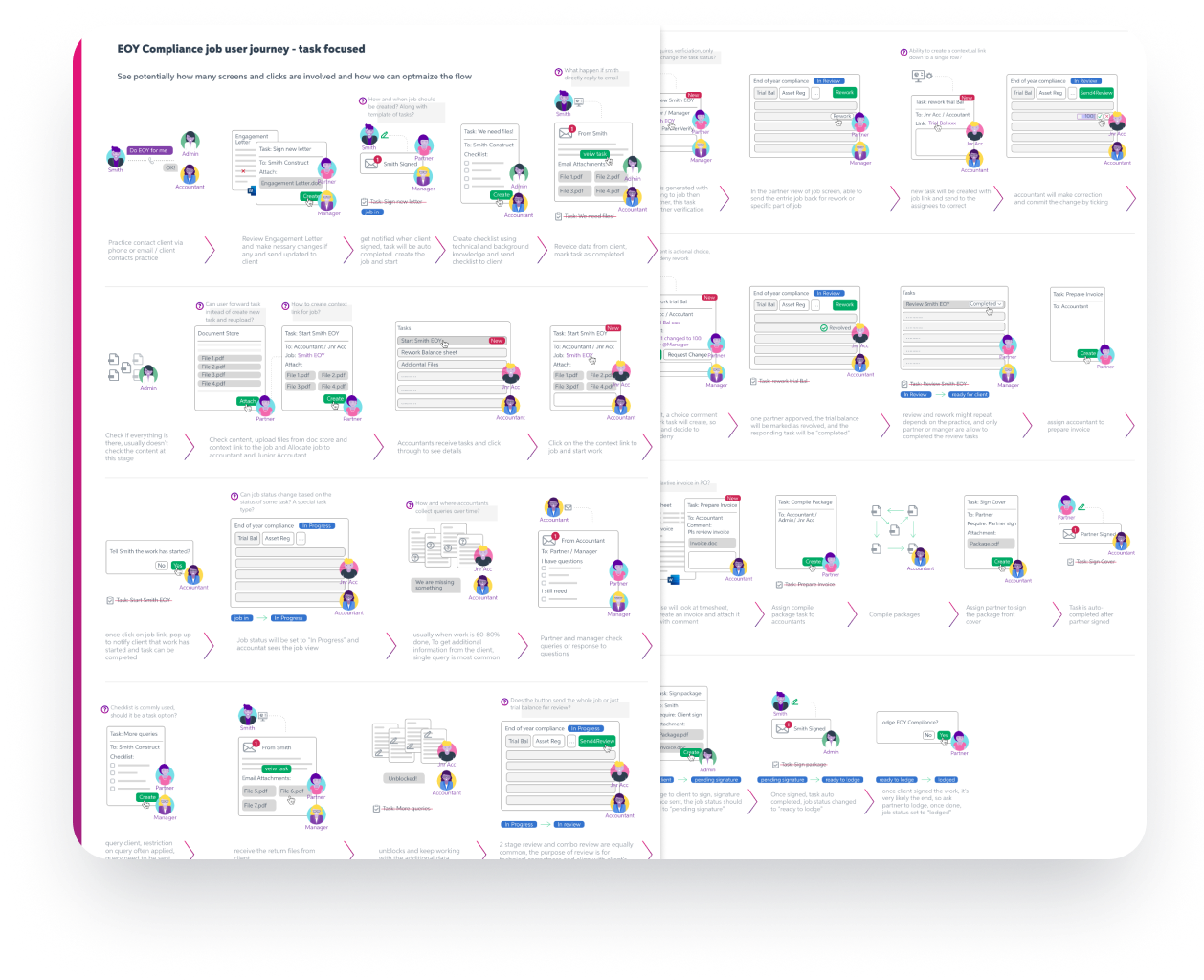

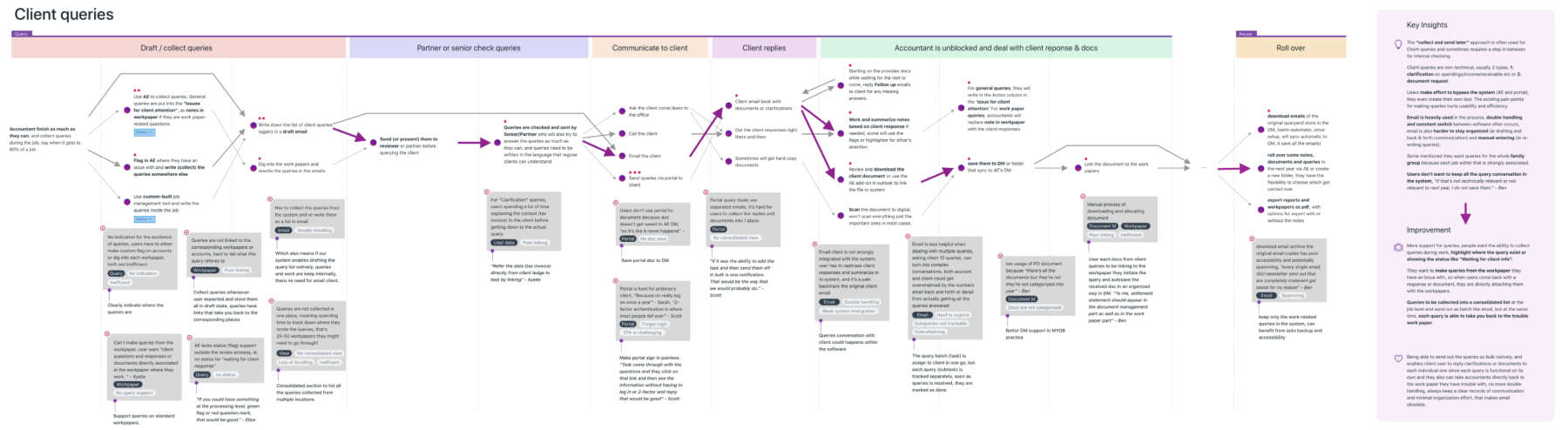

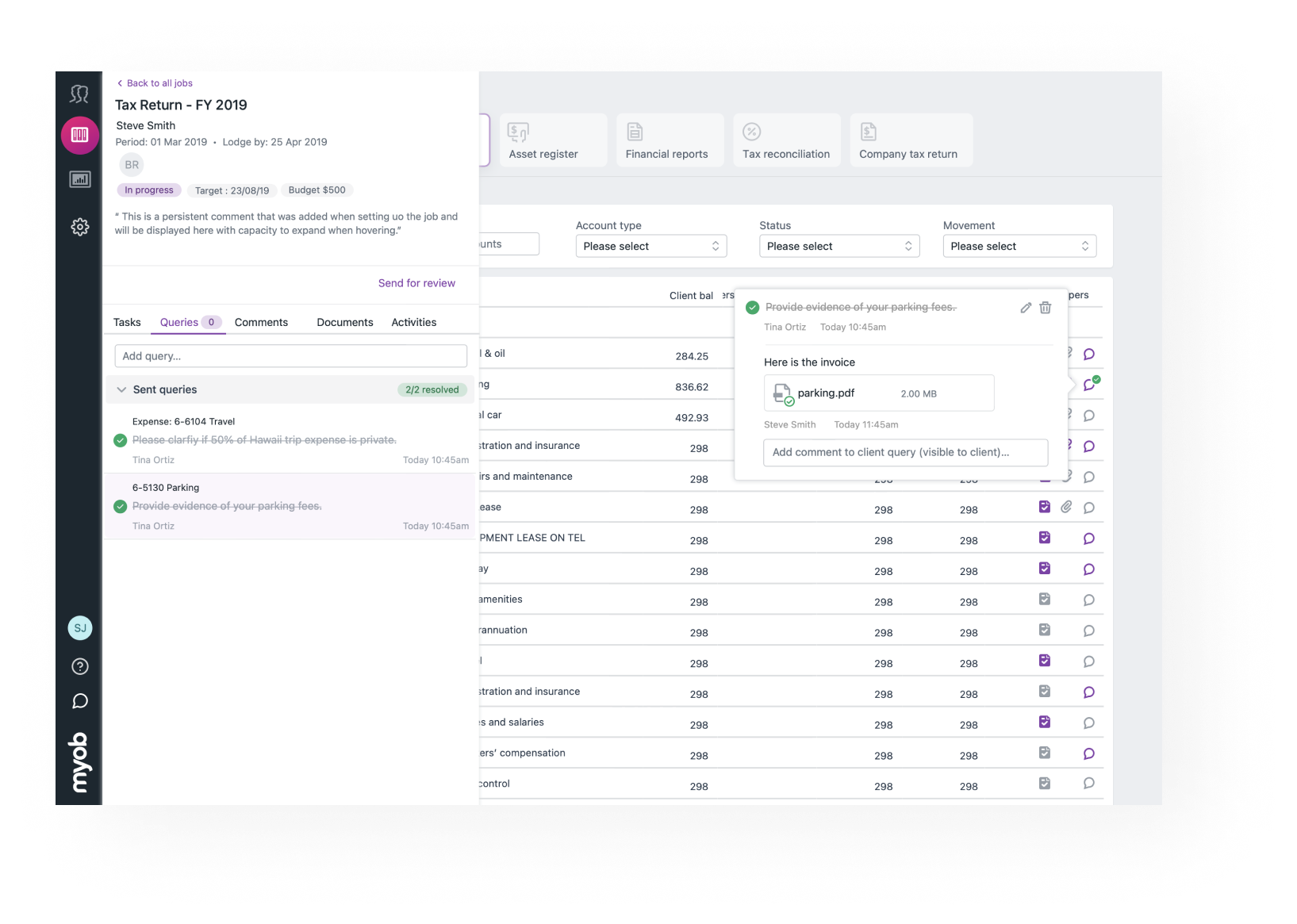

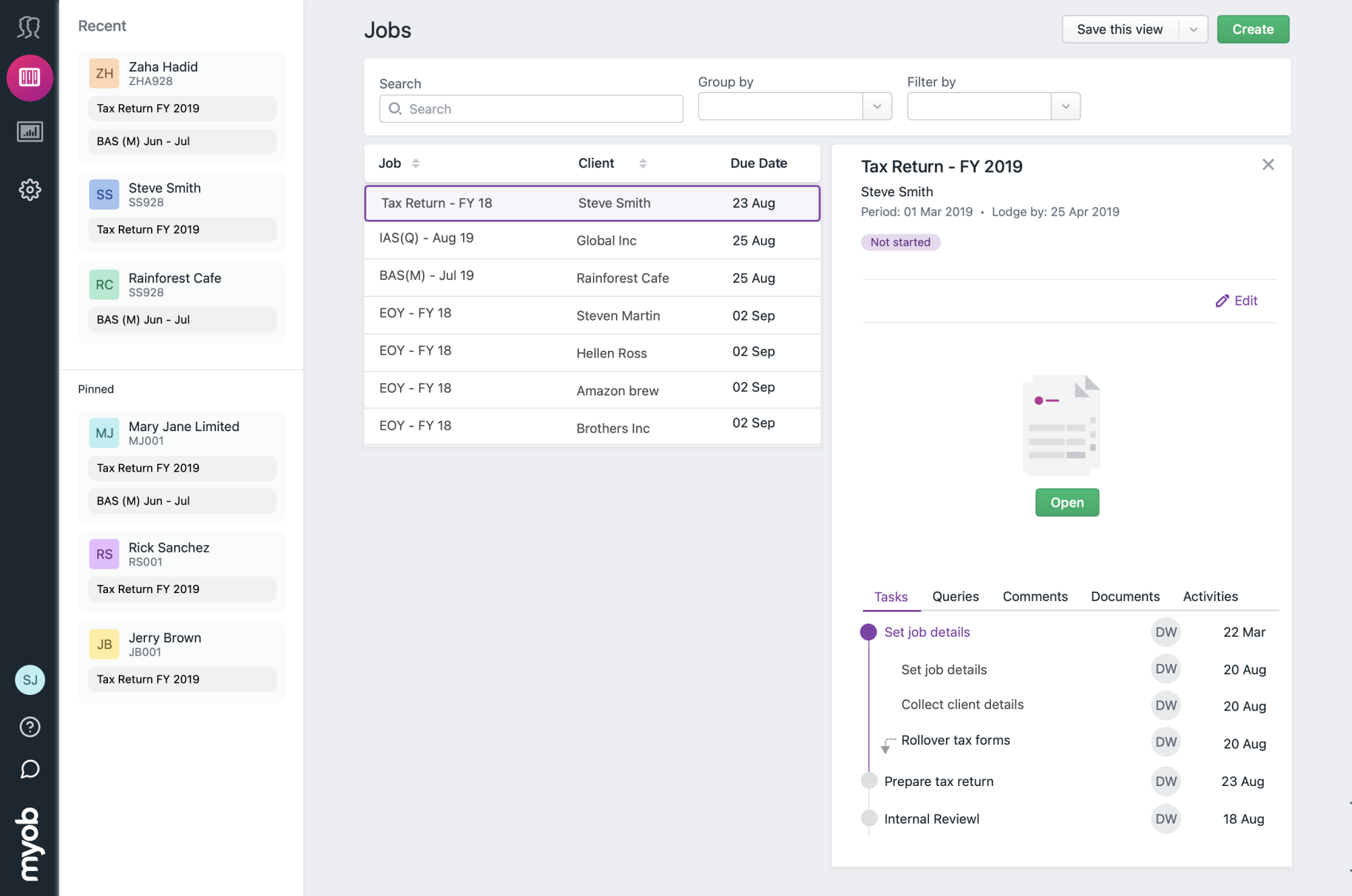

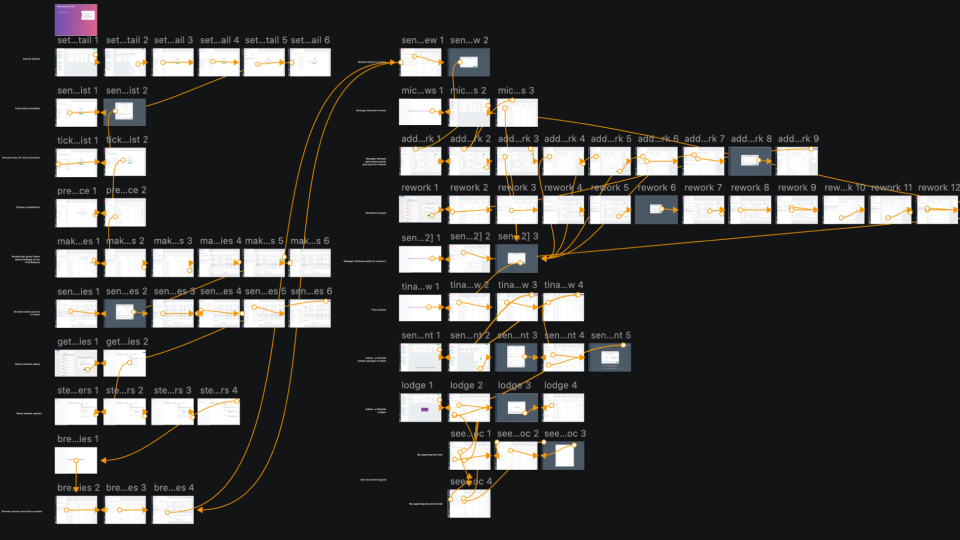

Pulling all the key parts of the workflow together by different designers into 1 cohesive piece, the prototype was presented at MYOB's roadshow - INCITE

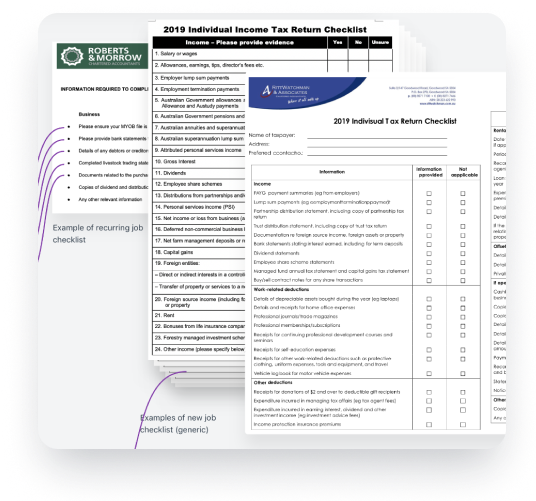

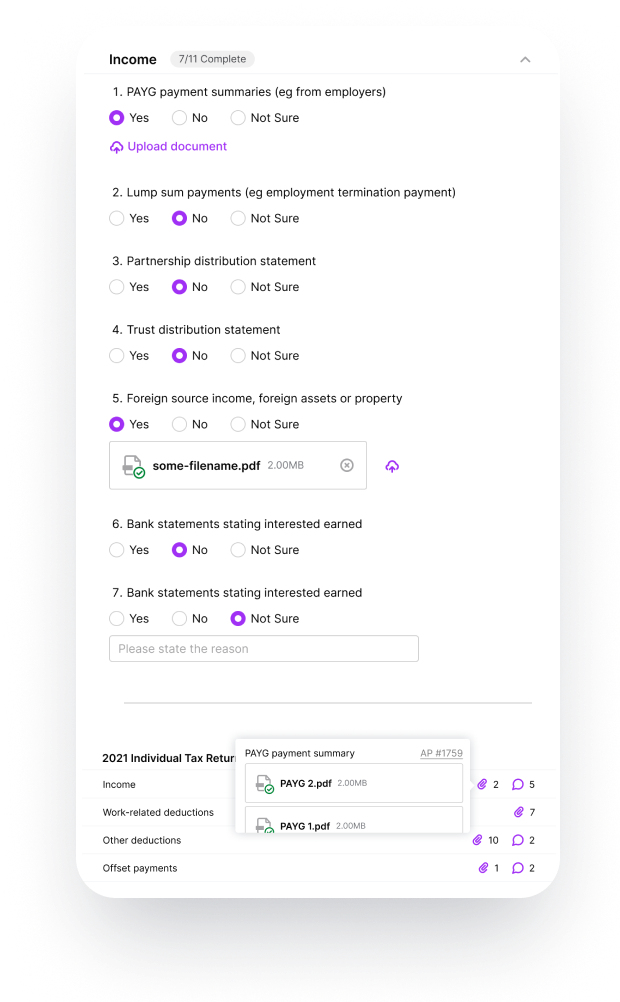

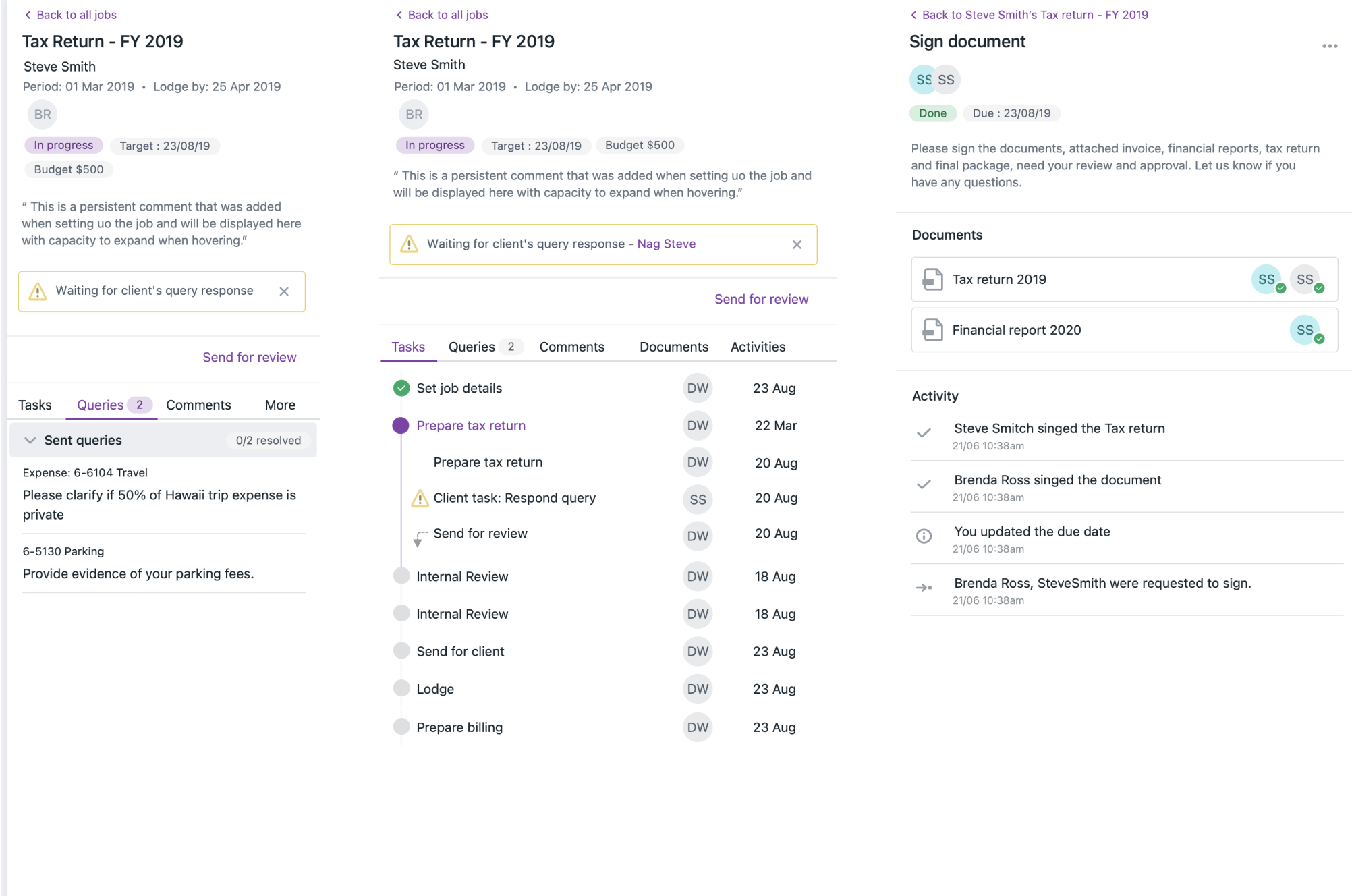

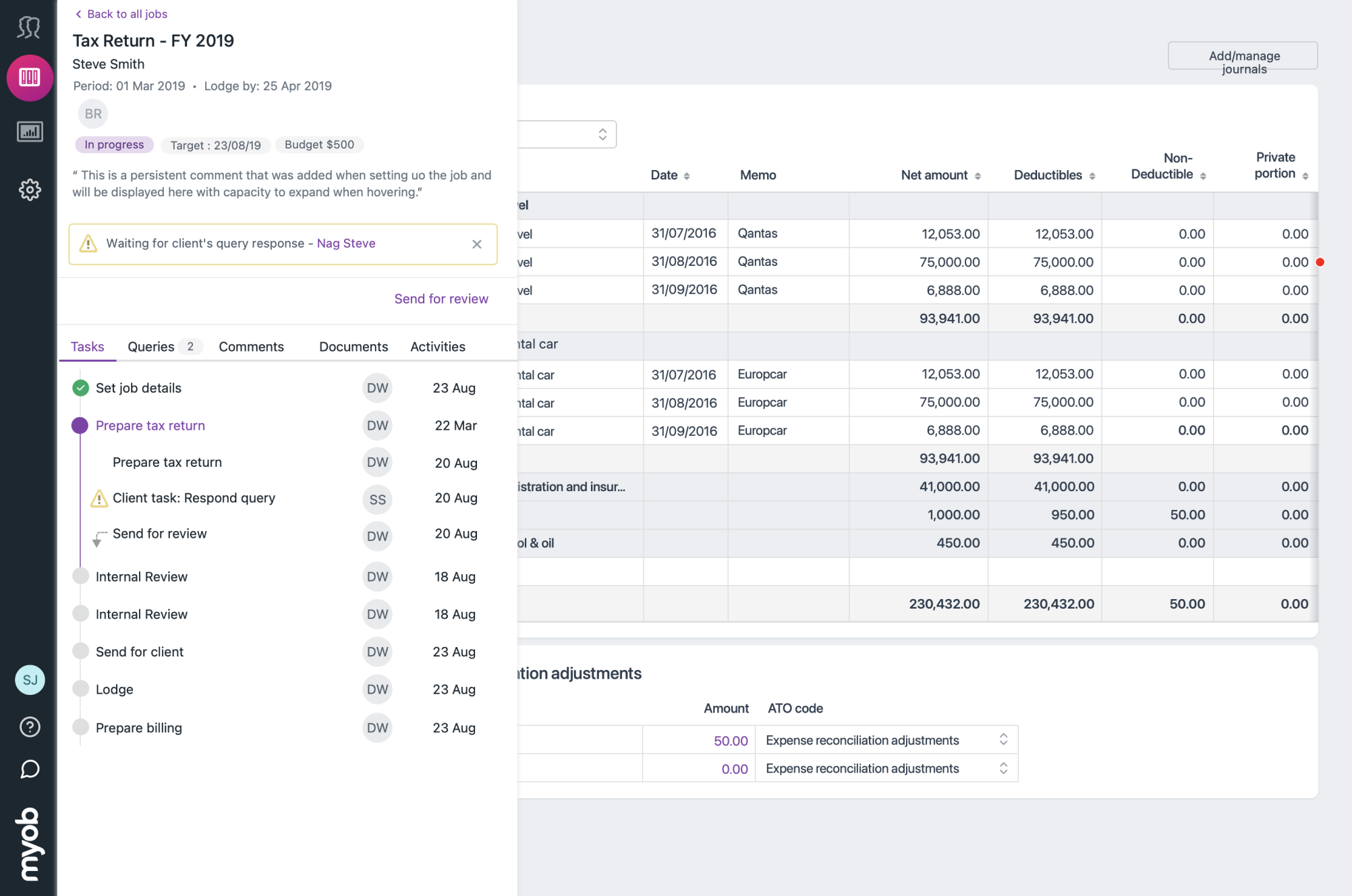

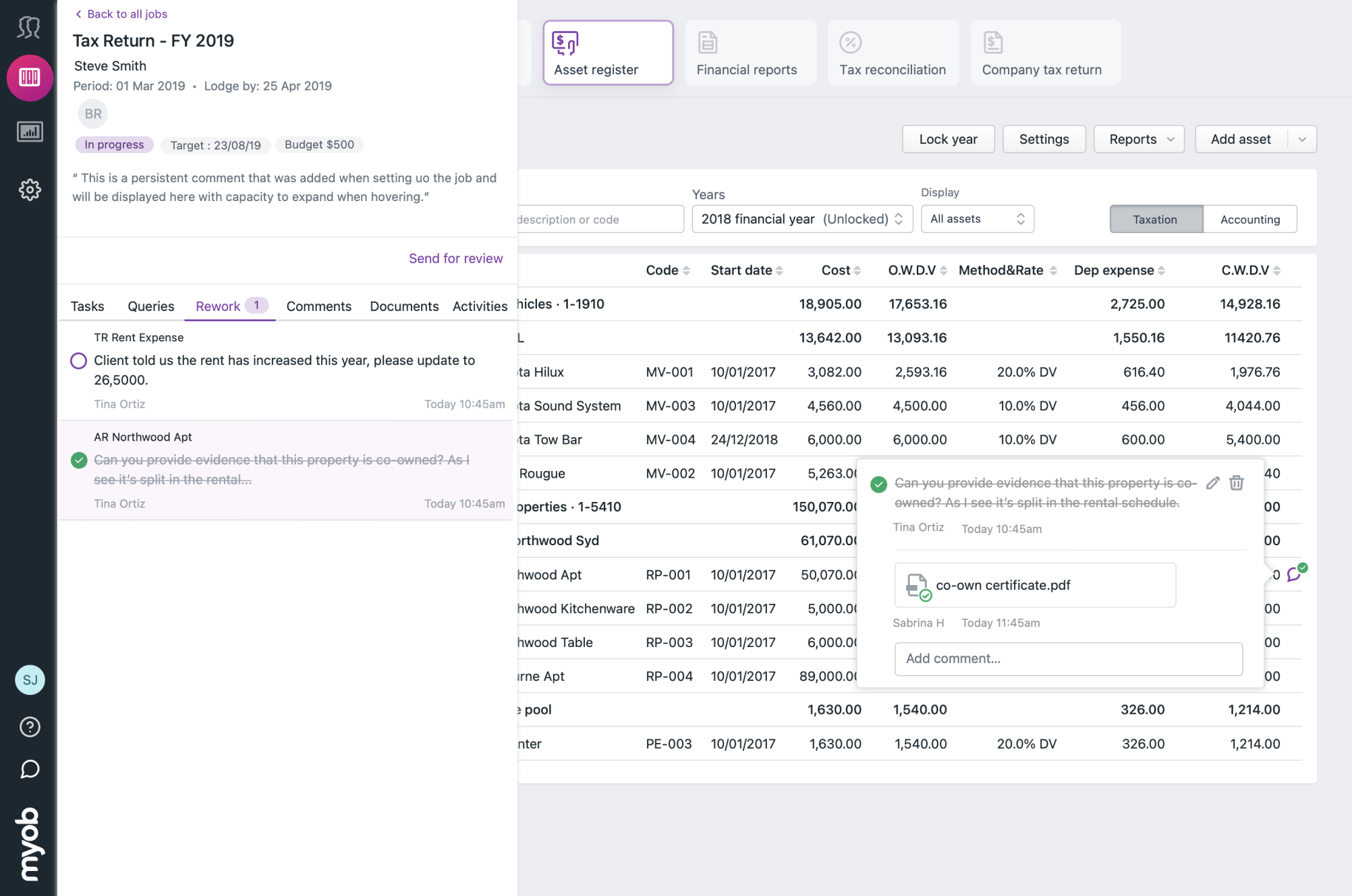

Piece all parts, tasks, client queries, checklists, review processes, job layouts, and core accounting done by different designers into a cohesive experience. Share with senior stakeholders, aligning it with their vision, and thanks for the regular feedback loop with them during the feature research and design. The approach was quickly approved and taken to our annual INCITE for the public.

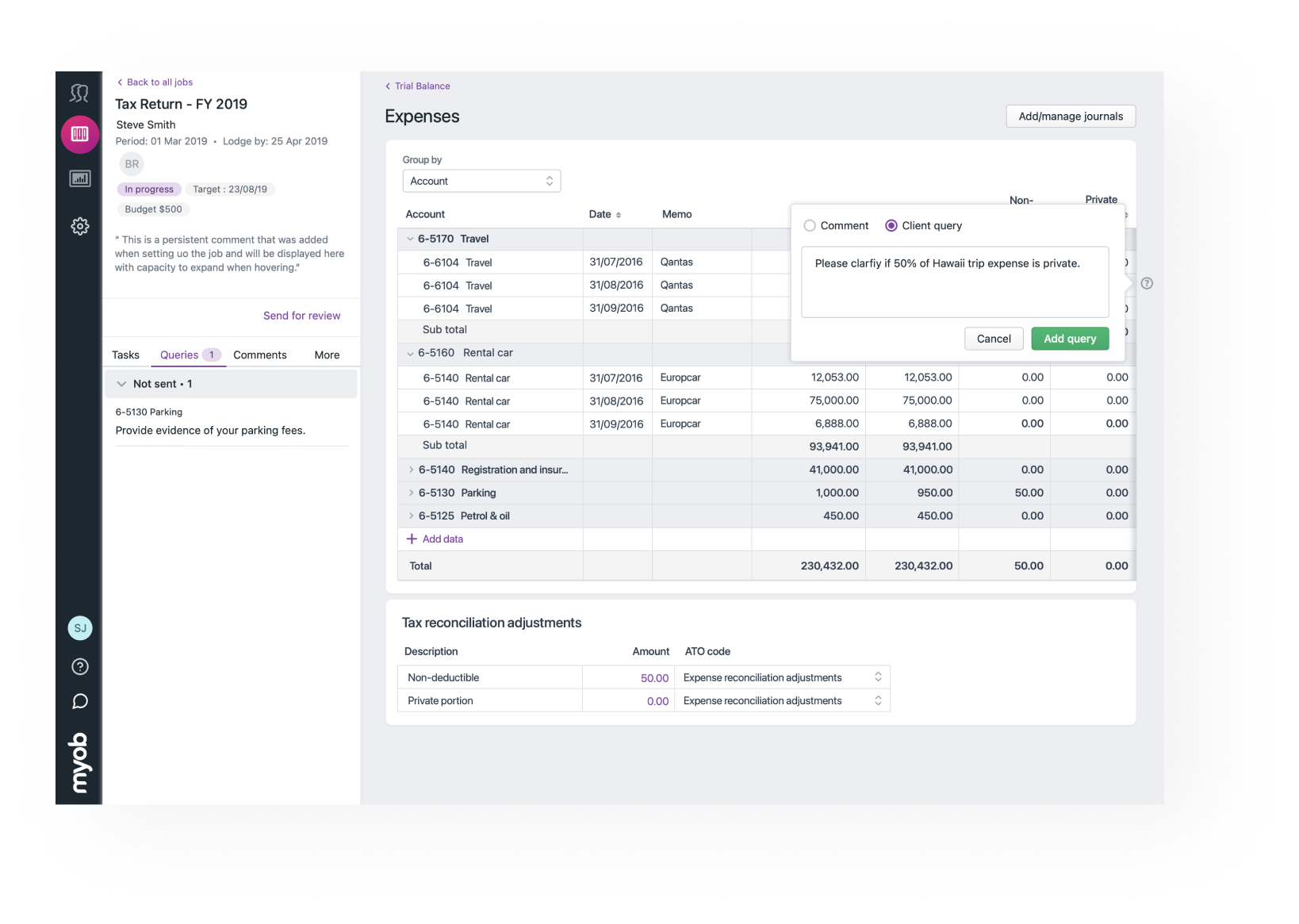

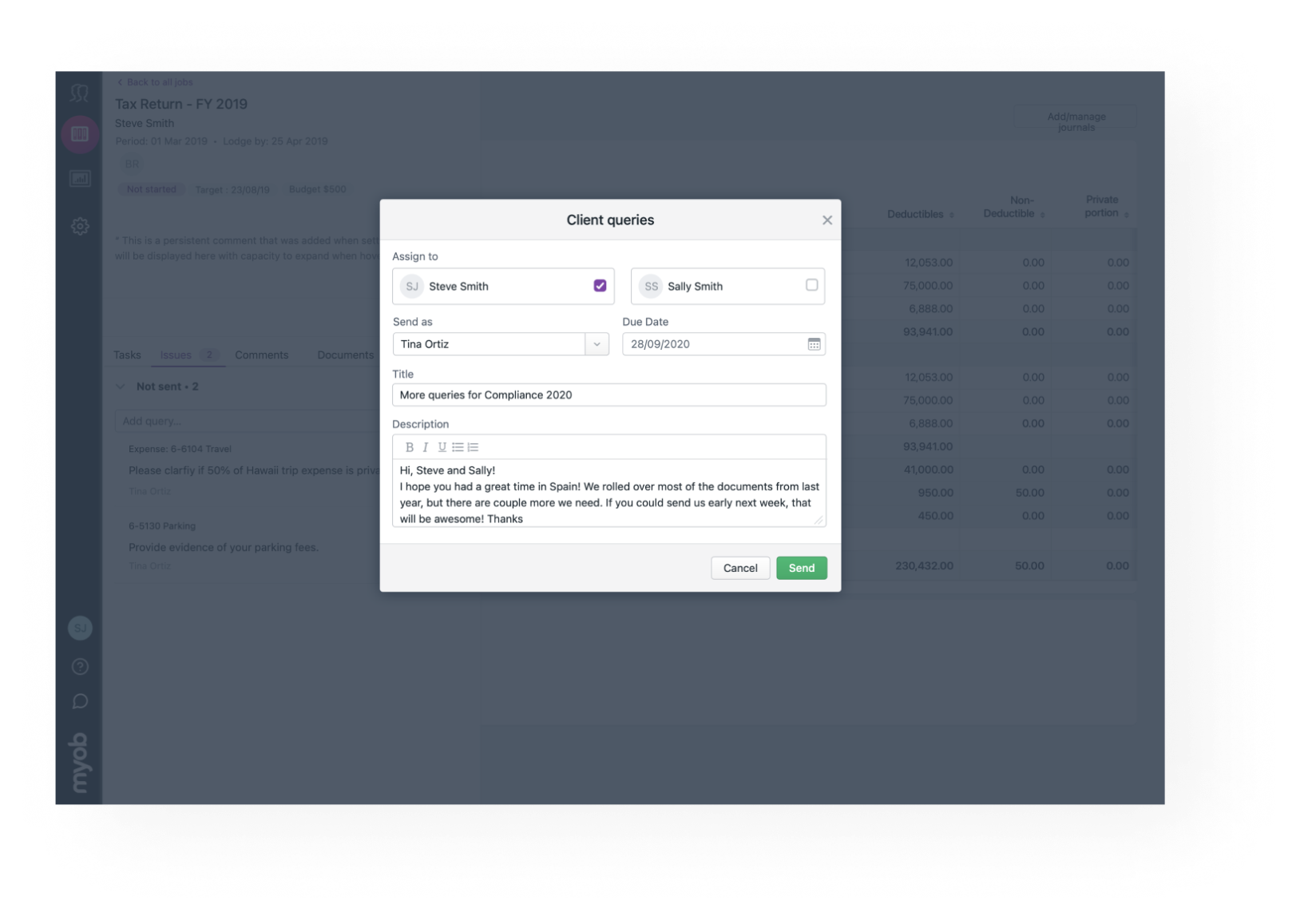

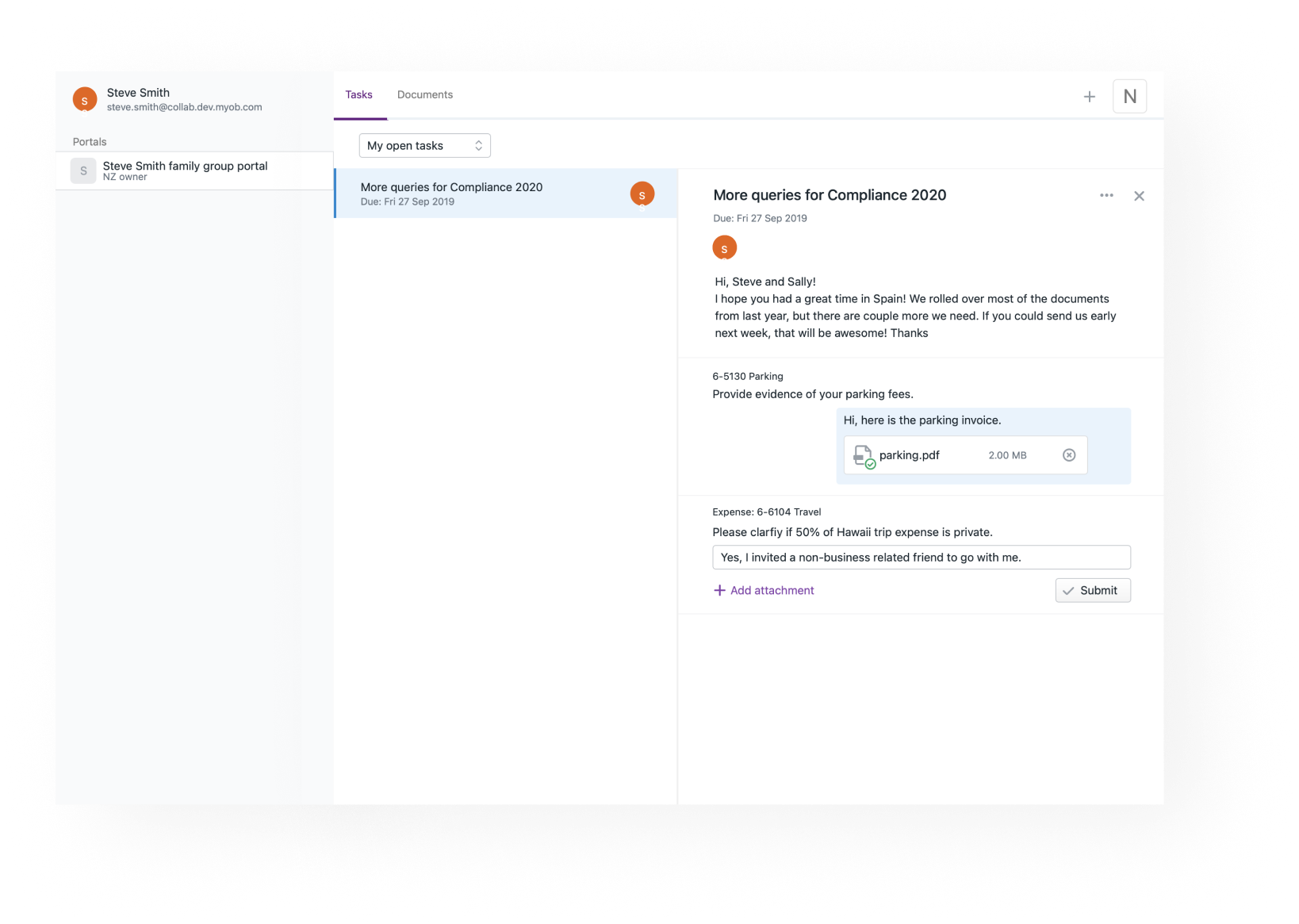

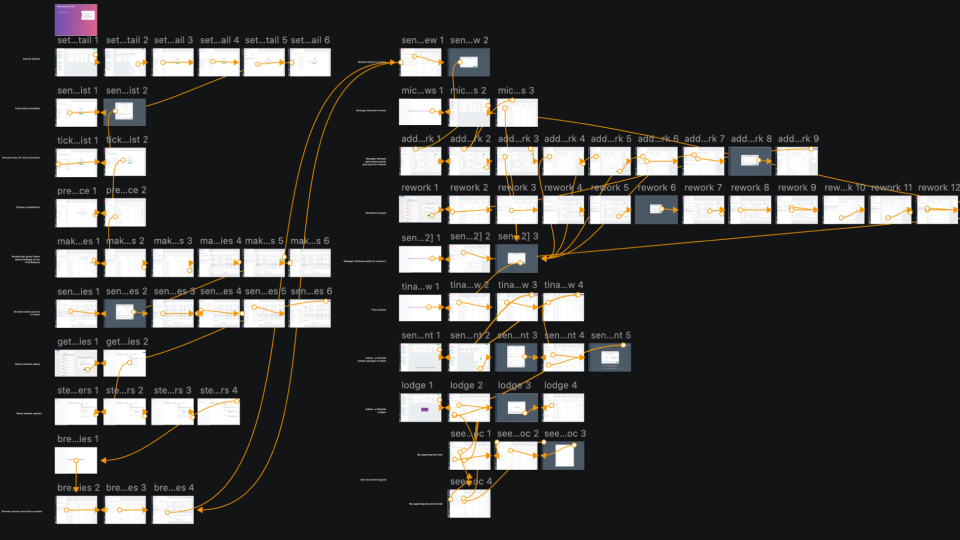

After several months of work, I designed 80 screens. It was challenging, to say the least, to see how different parts of the app interact, fill them with real-scale data, and go through scenarios in a holistic view. It's really exciting, and we revisited a number of practices with the proposed solution.